Chapter 12: Your Finances: The Black Box

Nowhere is the art of keeping more critical than in the realm of your finances. In India, money is never just money. It is a metric of worth, a tool of comparison, a source of jealousy, and a lever of control. To protect your peace, your financial life must become a black box.

The contents of the box—your exact salary, your net worth, the price of your car, the size of your investments—are for you and your trusted partners only. What the outside world sees is only the box itself.

When you disclose financial details, you invite consequences that have nothing to do with your well-being.

- Disclosure invites judgment. If you earn “too much,” your spending is scrutinized. If you earn “too little,” your life choices are questioned.

- Disclosure invites comparison. Your salary becomes a weapon in the endless game of social one-upmanship, creating resentment and envy where there was none.

- Disclosure invites interference. Family members feel they have a right to give you unsolicited advice, or worse, to ask for money, altering the dynamic of your relationships.

Applying the Strategic Filter to your finances is simple. Your desired outcome is almost always to maintain respectful, peaceful relationships. Disclosing your salary is rarely the best way to achieve this. The most likely unintended consequence is the introduction of judgment, comparison, and interference.

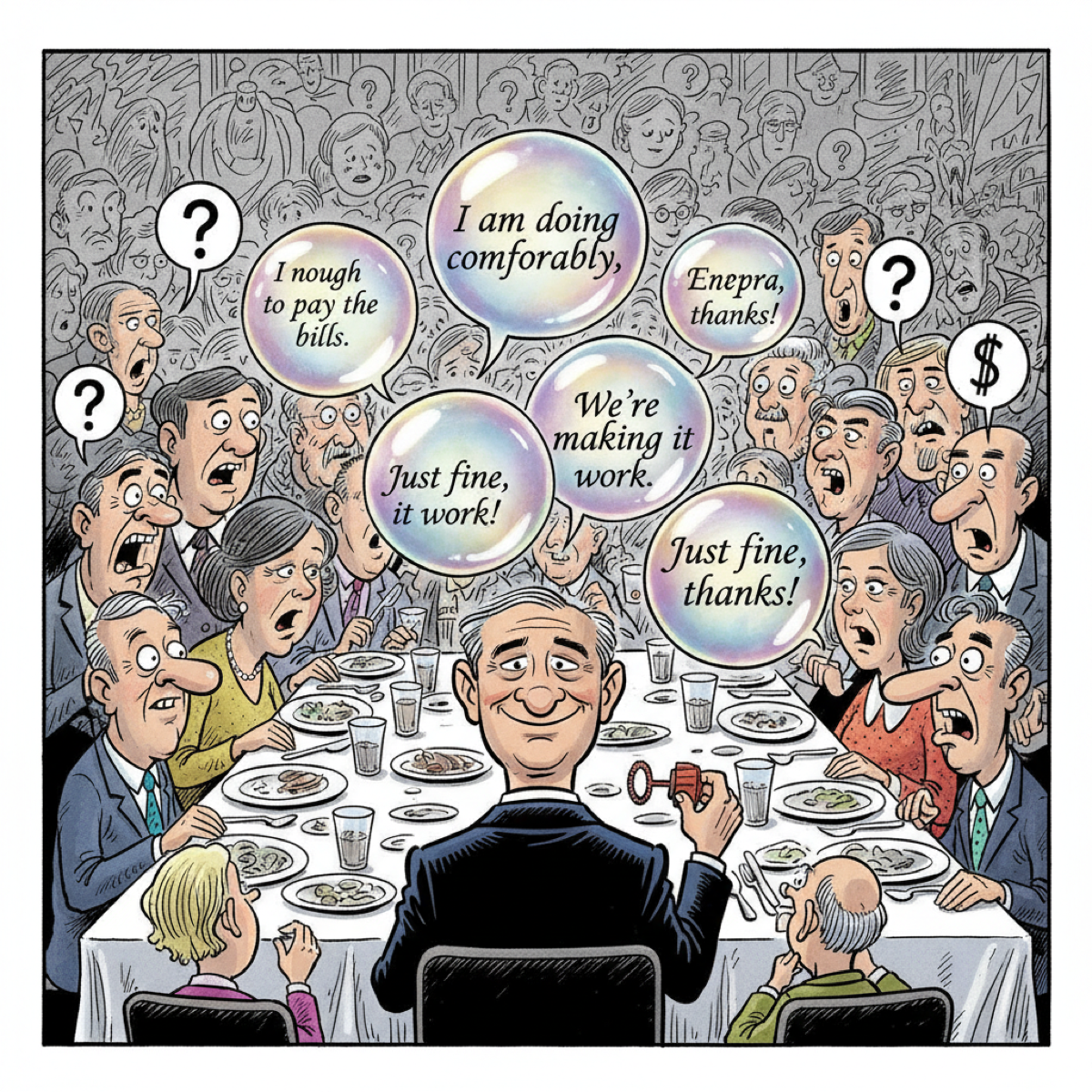

Therefore, the strategic choice is deflection. You must learn the gentle art of the non-answer.

When asked about your salary:

- “I’m doing comfortably, thank you.”

- “The company has a policy against discussing compensation, and I prefer to respect that.”

- (With a smile) “Enough to pay the bills.”

When asked about the price of a new purchase:

- “It was a considered purchase, and I’m very happy with it.”

- “I was fortunate to get a good deal.”

These are not lies. They are boundaries. You are not being secretive; you are being professional about the management of your own life. You are signaling that your finances are a private matter, a black box that is not open for public discussion.

Becoming Comfortable with Financial Boundaries: A Phased Approach

For many, especially within Indian cultural contexts, setting financial boundaries can feel unnatural or even disrespectful. It’s a skill that needs to be developed, and like any skill, it benefits from a phased approach:

- Phase 1: Internalization and Understanding (Reading & Reflection)

- Action: Read through these suggested responses and the underlying philosophy. Understand why these boundaries are necessary for your peace and healthy relationships.

- Goal: Shift your internal narrative from “I’m being rude” to “I’m protecting my well-being.” Reflect on past instances where disclosing financial information led to negative outcomes.

- Phase 2: Mental Rehearsal (Practice in Your Mind)

- Action: Before an anticipated interaction, mentally rehearse using these responses. Visualize the scenario and how you will calmly and confidently deliver your boundary.

- Goal: Build confidence and reduce anxiety associated with potential confrontations. Make the responses feel natural and accessible.

- Phase 3: Low-Stakes Application (Practice with Less Intrusive Questions)

- Action: Start applying these responses in situations where the stakes are lower, or the questioner is less likely to push aggressively. For example, a casual acquaintance asking about a minor purchase.

- Goal: Gain real-world experience and observe the positive impact of setting boundaries. This builds a foundation for more challenging interactions.

- Phase 4: Gradual Escalation (Practice with More Persistent Questioners)

- Action: As you become more comfortable, gradually apply these techniques to more persistent questioners or in situations where the financial inquiry is more direct.

- Goal: Develop resilience and refine your delivery. Learn to maintain your boundary even when faced with attempts to guilt-trip or pressure you.

- Phase 5: Mastery and Natural Integration (Effortless Boundary Setting)

- Action: With consistent practice, these responses will become second nature. You’ll find yourself effortlessly deflecting intrusive financial questions without internal conflict.

- Goal: Achieve a state where financial boundaries are a natural, integrated part of your communication style, contributing to more respectful and peaceful interactions.

Remember, this is a journey. Be patient with yourself, celebrate small victories, and understand that each successful boundary set strengthens your resolve and protects your personal space.